CNC Machine Financing and Purchasing Options

Finance can be a great way to acquire the latest CNC technology, allowing you to maintain cashflow while still getting access to the technology that you need.

With finance options ranging from traditional loans to equipment leasing and beyond, it’s possible for both small business owners or commercial ventures to get their hands on high-end CNC machines.

Commercial, industrial, or large format CNC equipment is ideal for financing and often commands some of the best interest rates and terms.

Top 4 Questions about Financing CNC Equipment

Yes – Almost all equipment manufacturers and distributors include training, shipping, support and installation at the time of purchase. In that case you can usually wrap it all into your equipment financing.

It can happen in as little as 4 business hours! Sometimes longer if we have requests for income, proof of business, bank verification, etc.

First, you decide on the equipment you would like to purchase including:

- Equipment company you want to buy from.

- Type of equipment and estimated cost.

- Apply by clicking here or the Application tab at the top of the page.

- Approval is next and can take as little as 4 hours.

- Once you are approved, we will email you approval terms to review and a finance rep will follow up to answer questions and walk you through the next step.

VERY competitive. Exact numbers always depend on what the current interest rates are in general, your time in business and terms of the loan, but this equipment and the right buyer is a very attractive combination for the financial institutions we work with.

Just call us and we can quickly give you specifics.

How Much Are CNC Machines?

CNC machines vary greatly in cost depending on the type and size of machine you’re looking for, as well as the brand name. Generally speaking 3-axis CNC routers start at around $5,000 with larger 5-axis models costing upwards of $20,000.

But the largest woodworking, cabinet manufacturing and factories in general use much more industrial CNCs. The DMS Mammoth CNC Router, for example, might sell for upwards of $400,000.

There is no cost limit to financing this kind of commercial equipment and Adia Capital has programs for every pricing bracket.

What Is the Difference Between CNC Financing and CNC Leasing?

CNC financing typically refers to either a loan or line of credit when it comes to purchasing a CNC machine. Depending on your financial situation, you may be eligible for competitive rates and long-term payment plans when financing a CNC machine with one of these options.

Leasing this kind of equipment is most often less desirable than more traditional financing because these machine qualify for such competitive interest rates.

Either choice is available through Adia Capital, of course, and if you have any specific questions about the differences and which might be better for your situation, please reach out directly.

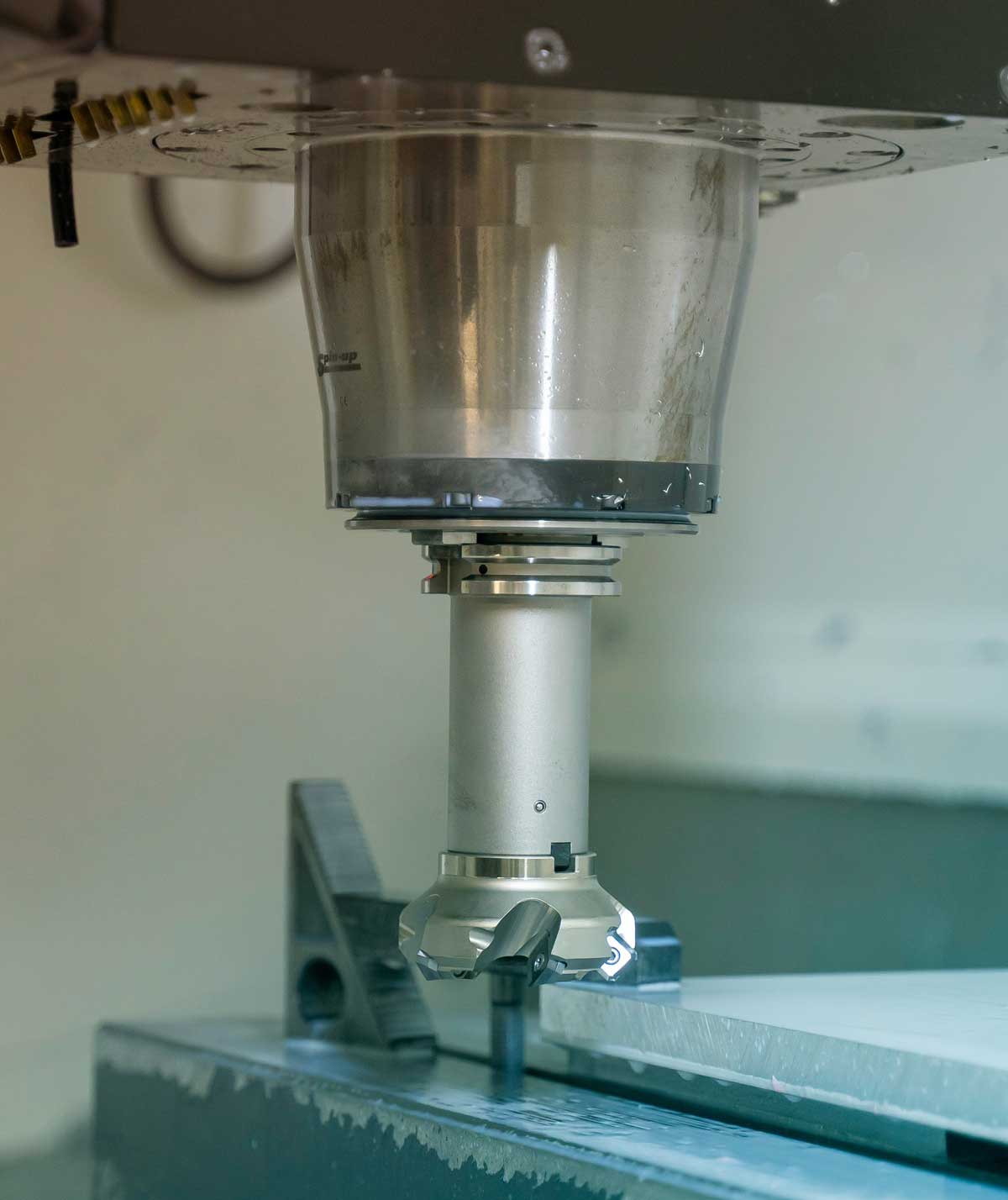

Types of CNC Machines You Can Finance

There are a wide variety of CNC machines available for different purposes.

For woodworking and cabinetmaking, desktop CNC routers are more often used. These smaller machines are typically much less expensive than the industrial models mentioned above, so they can be a good option if you have a smaller or less demanding application. While larger 5-axis technologies may be more appropriate for metal fabrication applications.

Those who need to do more complex tasks such as milling, grinding and drilling, industrial CNCs such as the DMS Mammoth CNC Router can be used. They allow users to quickly cut complex shapes in three dimensions with precise accuracy.

For prototyping and small-batch production, 3D printers are becoming increasingly popular as they’re relatively affordable and offer amazing results. Desktop laser engravers are also great tools for adding custom details to projects or creating intricate designs.

You can finance any kind of CNC but the types of machines you might need depends largely on what type of work you’re looking to do. Payment plans are available on all.

We can work closely with you on the financing side once you’ve selected the right one.

CNC Equipment List for Financing

- CNC Milling

- CNC Routers

- CNC Lathes (Turning)

- CNC 3D Printing

- CNC Laser Cutters

- CNC Plasma Cutters

- CNC Waterjet Machines

- CNC Grinders

No matter which type of CNC machine you need, there is likely a financing option available to help make the purchase more manageable.

Tax Breaks for Equipment Purchases – Section 179

Another benefit of financing a CNC machine is that you can take advantage of Section 179 deductions from your taxes. This section of the IRS tax code allows businesses to deduct up to $1,000,000 in qualified equipment purchases from their taxable income for the year.

Normally you would “write down” equipment, or take depreciation over 5 years or more. This section of the tax code allows you to take the entire amount as a deduction in the year the equipment is purchased and put into service. [Consult a tax professional for details].

While it may seem as if you have to wait until the 4th quarter to invest in new equipment in order to take advantage of the tax break, it’s just not necessary. You can purchase in January and still get the tax advantages!

You can read more about Section 179 and how financing makes that an even bigger win here.

Next Steps for Buying a CNC the Right Way!

But if you have questions first don’t hesitate to call, 866-757-0244.