There are 2 scenarios that usually start people’s interest in financing woodworking equipment:

Scenario 1:

You’re a woodworker, custom cabinet builder or furniture maker that is transitioning from a side-hustle or part time business. So, you need to outfit your current shop with woodworking machinery that will allow you to produce more, better and faster.

Scenario 2:

The business is already up and running in one or more of those areas and you want to GROW. And that means hiring others, upgrading your equipment for speed, volume and reliability, and getting your finances in order to do so.

We’ll go through some of the common questions that both start up woodworking businesses and current growth-mode shops have, then talk about the difference in financing or leasing woodworking equipment between them.

The short answer is YES! Because well-maintained woodworking equipment can last so long and still be very productive this is a common question.

We have options if you are buying used equipment directly from a vendor-dealer and from another business. This is often a great money saver on the purchase price, and that impacts your monthly payments/cash flow.

Call us to discuss the details before filling out an application for used equipment. 866-757-0244

Absolutely. You can lease new woodworking, cabinetry or manufacturing equipment using programs that offer $1, 10% and residual purchase options at the end of a lease.

And yes, we can help you determine which would be best for your situation.

Okay, this is typically the FIRST question. But it’s sometimes the most difficult to answer because it depends on a few important variables:

- Time in business

- Type of equipment

- Cost of equipment

- Current interest rates

This is also why we don’t recommend using online loan calculators. They can give you either a payment that you may not qualify for OR over estimate your payment and rob you of the opportunity to get better, or more equipment.

So, just call us to get a better idea of what your payment might look like for your business. There’s no obligation, and you’ll get more complete options and answers.

For more common questions you can review our FAQ page here

Financing Woodworking Equipment for Start Ups and Growing Businesses

- Most new businesses are going to purchase a variety of less expensive machines.

If you’re just starting out you might have a nice collection of hand tools and the local home improvement version of the necessary power tools like:

- Table saw - $300 to $1,000

- Miter saw - $150 to $500

- Band saw - $400 to $1,000

- Jointer - $300 to $800

- Planer - $300 to $800

- Lathe - $500 to $1,500

- Shaper - $400 to $1,000

- Router - $100 to $300

- Doweling machine - $200 to $500

- Scroll saw - $100 to $300

And others you’ll recognize. But when you step up to a more full-time production schedule, you’ll probably be replacing them with the next level up.

Like going from a 2HP dust collector to a $1,600 Baileigh or $2,600 cyclone. Or going from that plunge router to a small CNC.

So in your situation you might be financing multiple RELATIVELY smaller pieces vs one large manufacturing level machine.

Adia Capital can help you finance the more expensive of those items, freeing up your capital to pay cash for the less costly ones.

- Growing Businesses – Cabinet Maker Examples

If you’re a commercial fabricator, making cabinets for example, you might need to add tools on the higher end because you need make FASTER.

Imagine how much quicker you’ll get a custom kitchen built with a $17K Laguna sliding table saw or an $11K Makisawa sliding panel saw vs cutting 4X8’ plywood sheets the way you are now.

Here’s a short list of typical equipment you might upgrade and what you’d spend for boosting your cabinet-making production:

- Table saw - $800 to $3,000

- Miter saw - $300 to $1,000

- Band saw - $700 to $2,500

- Jointer - $500 to $1,500

- Planer - $500 to $1,500

- Doweling machine - $400 to $1,000

- Panel saw - $5,000 to $20,000

- Edge bander - $1,000 to $5,000

- CNC router - $5,000 to $100,000

Why Not Finance with the Seller?

The easiest thing to do if you’re looking for a piece of commercial equipment of any kind is to buy online and/or use the payment options that the vendor offers.

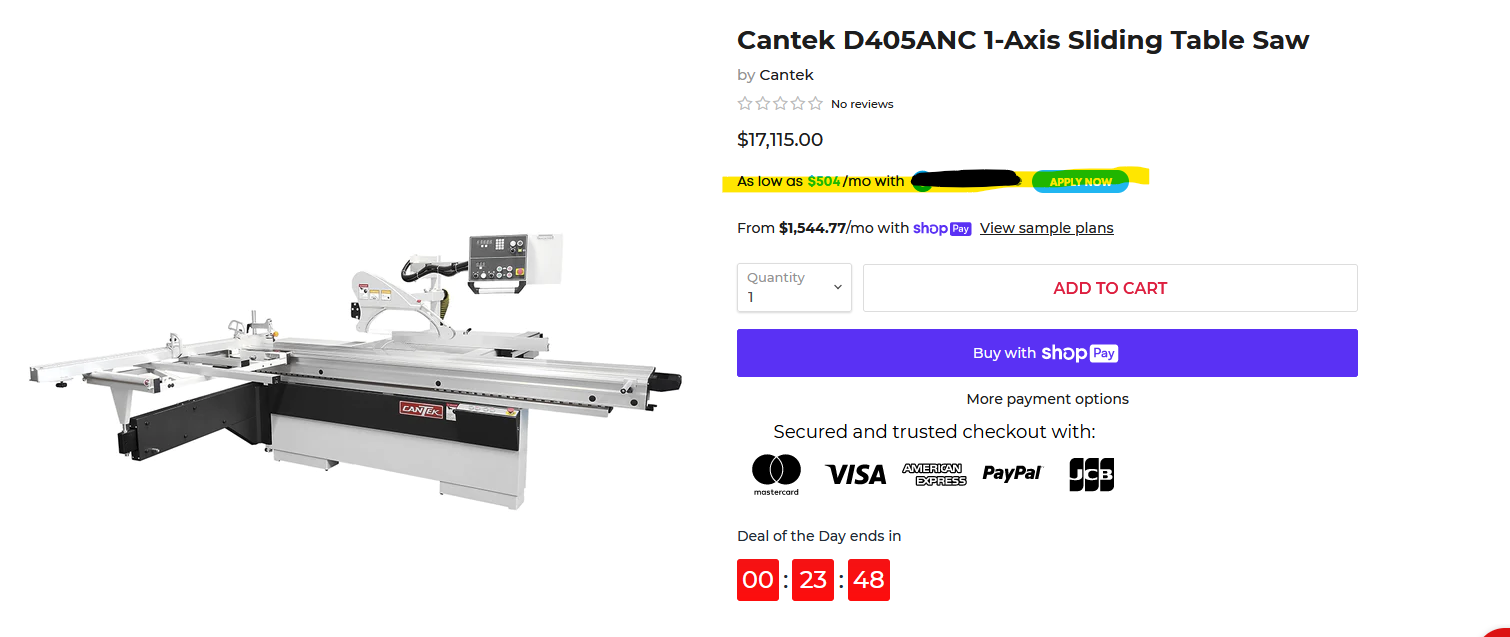

For example, if you buy a Cantek Sliding Table Saw from a company like the one show here, you’ll see a lease price advertisement:

But what you might not know is that when you go through a vendor like this you typically PAY MORE in payments and in overall costs. Because that leasing company rewards the seller financially for listing their company on the site.

So just as a general example of the potential difference between a “house” financing company and Adia Capital:

Website Direct Vendor: As Low As: $504/month

Adia Capital: Maximum of $375/month [with good credit and 2 years in business]

Just to put that into perspective, if you financed that $17,000 for 5 years at the $504/month payment you would spend $30,240 total (barring any additional fees, etc.)

With the Adia Capital financing option at $375/month you would pay $7,740 LESS

Upgrading your equipment BEFORE you buy

An alternative to saving money on that specific piece of equipment, for example, would be to spend the same monthly payment on either the next level up OR an additional item.

A quick example:

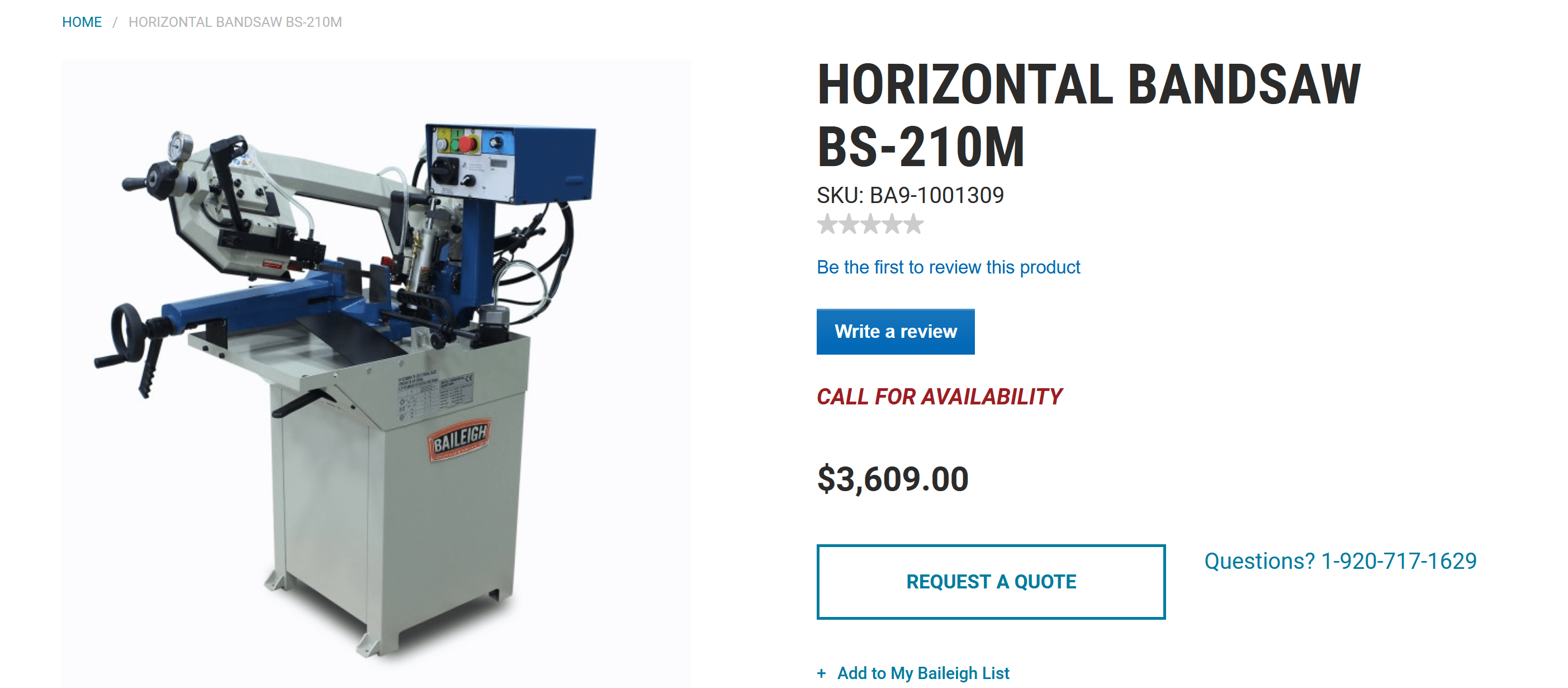

You could purchase this Baileigh BS-210 Horizontal Bandsaw AND the Cantek table saw show above…

… and still finance them BOTH for under $500/month!

Things to Consider when Financing Woodworking Equipment

Clearly, you’re going to pick the best equipment you can with the budget you have to work with. But just because you’re buying something from a quality vendor doesn’t mean their financing options are the best available.

Woodworking Machinery Manufacturing is a $941.7 million business, but their skill set is in manufacture, not finance.

You’ve seen the actual, real world savings you can gain – or additional equipment you can afford – when you meet the right finance broker.

That’s Adia Capital.

Call now or go right to the applications page here and get started growing your woodworking, cabinetry or custom furniture business!