If you run a construction company that needs new heavy equipment, you are the financing and financing rate winners of the current economy.

Heavy equipment can be financed for the lowest comparative rate we’ve seen in decades. As the base rate rises and impacts financing costs for most other equipment – yellow iron can still be done for under 5%*.

Why Finance Heavy Equipment

Upgrading equipment does 3 things for your growing construction business. We’ll take a quick look at each one of these in turn:

#1:

Reduces LABOR costs

#2:

Shortens project times

#3:

Increases your Capabilities

Reducing Labor Costs and Solving for Labor Shortages in Construction

Cost of labor is probably one of your biggest expenses, and the current labor shortages have had a double impact on your bottom line.

The first impact, of course, is that with fewer people your projects take more time – but maybe even more importantly is that the labor you DO have costs more per hour than ever before.

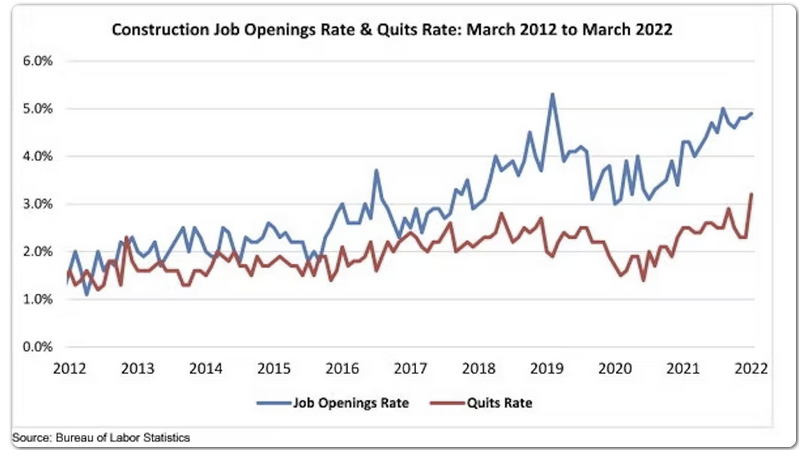

Simple supply and demand mean that as job openings (demand) increase and fewer people WANT to work (demand), the cost of those that do goes UP. According to the Census Bureau there were almost 400,000 openings just a few months ago.

Heavy equipment financing or leasing is a real problem solver for that exact situation.

In the simplest example, just imagine the difference in cost and efficiency between a crew with shovels and a walk-behind trencher. 4 people for hours or 1 person and the right piece of construction equipment for a fraction of the time.

You can be long-term more labor cost effective with the first purchase of the right tool.

When it comes to construction projects, labor costs are one of the biggest expenses. Companies can save a significant amount of money by investing in new heavy equipment for their projects.

The use of new and advanced construction machinery helps reduce labor costs significantly due to its ability to work faster and more efficiently than manual labor.

How to Shorten Construction Project Time

Obviously when you operate your jobs more efficiently you can finish more quickly.

And both augmenting or replacing part of your existing labor pool by financing heavy equipment instead will boost that efficiency by more than you might think.

When you’re on a job site there are a few things that can pretty consistently throw a monkey wrench into your schedule.

People:

Have you ever had more than 1 person, or even an entire crew just not show up onsite?

Let’s say you’re using 50 direct employees and subcontractors – there can’t be more than a week that goes by without some kind of personnel issue, sick out or complete disappearance.

Heavy equipment, the good brands that are made to last, are built to work every day, all day. They don’t get sick, need a day off or take an offer for a little more money on a different project.

The more that you can automate and move manual tasks from human hands to yellow iron the more you can get done without the risk of no-shows.

Rentals:

Renting an Art Wheel Loader or something similar is a great way to temporarily augment your capabilities. You’re probably already doing that on a regular basis.

The problem with renting equipment is that if you’re in an area where everywhere you look you see construction – the piece you need might not be available at the time you need it. That means you may be delaying the build or having to tweak your schedule to accommodate that availability.

And the price you might pay to rent a John Deere 624 articulated wheel loader for example (about $2600/week) means you are not just flushing that time down the drain, but your cash as well.

Bringing your own equipment in house reduces your need for labor and your reliance on construction rental equipment saving you both TIME and MONEY.

By the way – that weekly rental price quoted above will pay your MONTHLY payment on approximately $130,000 worth of heavy equipment!

Increasing your Capabilities Through Financing

When you invest in new or even great quality used heavy equipment, you are increasing your ability to do the work. OR even better, you’re expanding the kind of work you can do.

There are normally 2 ways you can grow any business. Those apply to your subcontracting company just like any other.

#1: Get more customers

What most business owners and managers think when they go for growth is gaining new clients.

Building relationships with new architects, designers, developers, planners and engineers, etc.

Maybe even expanding the geographic area the cover.

This is a great way to grow! And it’s even easier to get those new customers if you have some shiny new equipment. Because that demonstrates both your physical ability to do the job and signals your financial stability.

The downside to new customers is that they’re expensive to get.

You have to GO to those new geographic areas, MAKE those new connections or even just search for and respond to those new RFQs.

And your time is your most valuable asset.

#2: Do more for CURRENT customers

What adding more yellow iron to your stable does is allows you to do more, and make more money with, your existing customers. That reduces your personal time expenditure and your marketing expenses to essentially ZERO $$.

Other than the monthly cost of that equipment of course.

The best thing about this approach is that you may not even need to increase the types or work you do or can handle.

Just by using automation to shorten your job time will make your company more available for work from the same customers!

If you can cut your time by 10% because of new equipment you’ve just freed up that time to take 10% more work!

The more efficient you are and the more your current customers see you grow and expand the more they’ll USE YOU.

Financing rates for commercial equipment

You can go to any loan calculator on the internet and get a rough idea of what your payments might be on a standard 5 year load for financing heavy equipment.

But if you’ve read this far you probably already know what kind of equipment you want. What you really need is a financial partner to:

- walk you through the process

- find you the very best deal on the money you need to invest

- AND can speak plain English about your options.

That’s Adia Capital! Just call us. Or you can even complete the application here on the website before we talk – there’s no obligation either way.