Municipal leasing can help your growing your city, county or township. Because growing requires more than just the votes, participation and community support – it requires equipment and infrastructure.

And during the first years of a municipality, or a strong growth phase, leasing that equipment is almost always a necessity. Because the right leasing programs allow you to make the most of your current revenues, allowing your community to benefit as soon as possible.

In this article we’ll go through the kinds of equipment your municipality might lease or finance which should inspire your path forward. Then we’ll review a few different finance options for your consideration.

Equipment Eligible for Municipal Leases

This is, of course, not a complete list. The needs of municipalities vary almost as much as the cities themselves.

But as you look through this list you can imaging the potential costs stacking up high enough that financing make sense even for the smallest municipalities.

- Public works equipment such as trucks, excavators, and road maintenance equipment

- Police and fire department vehicles and equipment

- Garbage Trucks

- Traffic control equipment

- Park and recreation equipment

- Playground equipment and athletic field maintenance equipment

- Waste management equipment such as garbage trucks and recycling equipment

- Street lighting and traffic signal equipment

- Information technology equipment such as computers and servers

- Emergency management equipment

- Public transportation vehicles and equipment

- Building maintenance equipment

Sample costs for Waste Management Equipment

While some cities successfully outsource some or all waste management functions, many cities keep this function “in-house” as well. It can be more cost effective and demonstrably supports local employment if you finance the following rather than outsource the service as a whole.

Here are just some of the items involved in the waste management part of civic organization, and their respective sample pricing vs. municipal lease payments:

Garbage Trucks and Recycling Trucks

>$200,000

These vehicles are used to collect and transport solid waste to a landfill or waste processing facility.

Compactor

Machines

$50,000 – $150,000

These self-contained compactors are stationary machines that are used to compress and compact waste, making it more efficient to transport and dispose of. Depending on the size of the municipality you may need more than one in more than one location.

Commercial

Dumpsters

$2,000-$4000

Commercial dumpsters that might serve a government building are only $2,000-$4000 each. But that ads up when you consider the sheer volume needed.

Baler

Machines

$20,000

These are machines used to compress and bind waste materials into compact bales for easy transport and disposal.

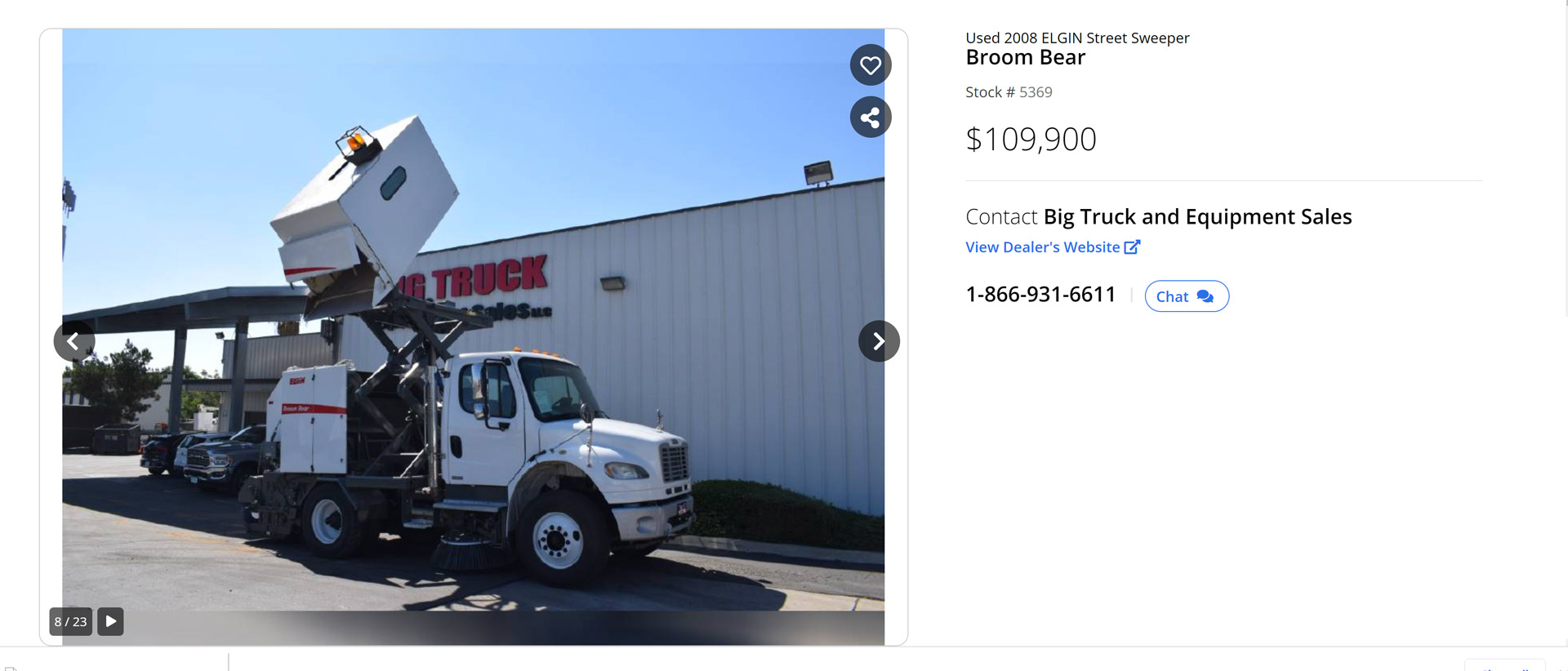

Street

Sweepers

$109,000+

For an example of what kind of investment even USED Street Sweepers cost we found a 2008 Elgin Broom Bear for $109,000.

Sample Costs for Municipal LED Lighting Upgrades

Just like many retail businesses, commercial spaces and parking lots, many municipalities are seeing the long term savings in LED lighting installations and upgrades.

Installing LED lighting for municipal areas can be a cost-effective way of improving safety, reducing energy consumption and increasing visibility.

The cost of a project that involves LED pathway lighting poles as pictured here can add up quickly. With each of this kind of pole costing between $1300 and $3,000 each depending on the configuration, municipal project costs can be significant.

On average, the total cost of a typical municpal outdoor LED lighting project is around $50,000 to $110,000 for installation and equipment costs. This includes the purchase and installation of new LED light fixtures, as well as any associated wiring and control systems.

Financing to help cover the initial installation costs for municipal LED upgrades can make it easier for cities to make the switch from traditional lighting. And that means long term savings for the tax payers.

Making the switch to LED lighting can be a cost-effective, energy-saving investment for municipalities. LED lighting upgrades can reduce electricity costs by up to 70%, and LED bulbs last up to 10 times longer than traditional lighting fixtures.

Financing these projects can actually turn into positive cash flow when you consider the power savings, any state or federal incentives that may be available, and how you use your monthly energy savings.

Getting the BEST Municipal Leasing Pricing on Equipment

One trap many new or smaller municipalities fall into is using the in-house financing arm of the manufacturer, distributor or used equipment dealer that they find.

That’s because the way that municipal equipment leasing through a dealer works, the city always ends up spending more money on payments, and so in total costs as well.

When you finance through a dealer, the leasing or financing company typically has a contractual arrangement with them that includes sharing some of the money the leasing company normally makes with the seller. Generally the interest rate, and your payment, is higher because the municipal finance company is adding a percentage point or some other fraction of the rate they charge to you so they can pay the selling company.

There’s noting wrong with this arrangement, you are just paying for the perceived convenience of the one stop shop.

And with pricing like this example of that used 2008 Broom Bear Street Sweeper for sale, every penny counts!

Experience Working with Municipalities and Municipal Leases

As a decision maker or “recommender” you know that working with a city, township, borough or parish can be a challenge. Or at least generate the need to address things in a particular way to get things accomplished.

Having a finance company like Adia Capital, with experience helping municipalities lease and finance equipment, can streamline the process for you a great deal. And that will get your new program up and running faster.